Democratizing Access to Credit Through Decentralized Finance

A decentralized lending marketplace built on XRPL (XRP Ledger) that enables peer-to-peer lending with verifiable credentials, multi-signature support, and automated settlement.

- About the Project

- Inspiration

- Key Features

- Demo Video

- Tech Stack

- Getting Started

- What We Learned

- Accomplishments

- Roadmap

- Contributing

- License

- Acknowledgments

LendX is a decentralized lending platform that leverages the XRP Ledger to create a trustless, efficient marketplace for peer-to-peer lending. By combining blockchain technology with modern UX design, we're making financial services accessible to underserved populations in emerging markets.

Key Benefits:

- Transaction fees of fractions of a cent

- Trustless loan agreements secured by blockchain

- Native wallet integration for seamless user experience

- Verifiable credentials for identity and reputation

- Real-time settlement with instant confirmation

Financial inclusion remains one of the world's greatest challenges. Traditional banking systems fail to serve billions of people, particularly in emerging markets. We were inspired by the potential of decentralized finance (DeFi) to democratize access to credit for small business owners and entrepreneurs in regions like Southeast Asia, Africa, and Latin America.

The Problem:

- 1.7 billion adults globally remain unbanked

- Traditional credit scoring excludes individuals without formal financial history

- High banking fees make microlending economically unviable

- Cross-border lending is prohibitively expensive and slow

Our Solution:

LendX leverages XRPL's low transaction costs (fractions of a cent) and fast settlement times (3-5 seconds) to make microlending economically viable at scale.

- Browse lending pools with transparent rates and terms

- Submit loan applications with purpose descriptions

- Track application progress and repayment schedules in real-time

- Make loan payments with instant on-chain settlement

- Build on-chain reputation through successful repayments

- Create lending pools with configurable interest rates, terms, and minimum amounts

- View pool analytics and historical returns

- Review and approve loan applications

- Manage funds and adjust pool parameters

- Multi-signature support for institutional lenders

- Native XRPL integration without external wallet dependencies

- Multi-Purpose Tokens (MPT) representing loans on-chain

- Escrow transactions for trustless loan security

- DID-based verifiable credentials

- Real-time WebSocket updates for instant transaction feedback

lendx/

├── frontend/ # Next.js 14 application

│ ├── app/ # App router pages

│ │ ├── (auth)/ # Authentication pages

│ │ └── (dashboard)/ # Main dashboard

│ ├── components/ # React UI components

│ │ ├── lendx/ # Core lending components

│ │ ├── ui/ # Shadcn/ui base components

│ │ └── dashboard/ # Dashboard components

│ └── lib/ # Utility libraries

│ └── xrpl/ # XRPL integration

├── backend/ # Python FastAPI services

│ ├── xrpl_client/ # XRPL client library

│ │ ├── client.py # Connection and transactions

│ │ ├── mpt.py # Multi-Purpose Token operations

│ │ ├── escrow.py # Escrow transactions

│ │ └── multisig.py # Multi-signature accounts

│ ├── api/ # FastAPI application

│ └── tests/ # Test suite

└── README.md

- Node.js 18+

- Python 3.11+

- Git

# Clone the repository

git clone https://github.com/sureenheer/lendx.git

cd lendx

# Navigate to frontend

cd frontend

# Install dependencies

npm install --legacy-peer-deps

# Create environment file

cp .env.example .env.local

# Add your Auth0 and XRPL configuration

# Start development server

npm run dev

# Frontend runs on http://localhost:3000# From project root

python -m venv venv

source venv/bin/activate # On Windows: venv\Scripts\activate

# Install dependencies

pip install -e .

# Run tests

pytest

# Start FastAPI server

uvicorn backend.api.main:app --reloadThe LendX frontend provides two main interfaces:

- Landing Page (

/): Welcome page with Auth0 login/signup - Dashboard (

/dashboard): Main application with dual-role interface

Lender Dashboard:

- Create lending pools with custom rates and terms

- View pool statistics and available liquidity

- Approve/reject loan requests

- Withdraw funds from pools

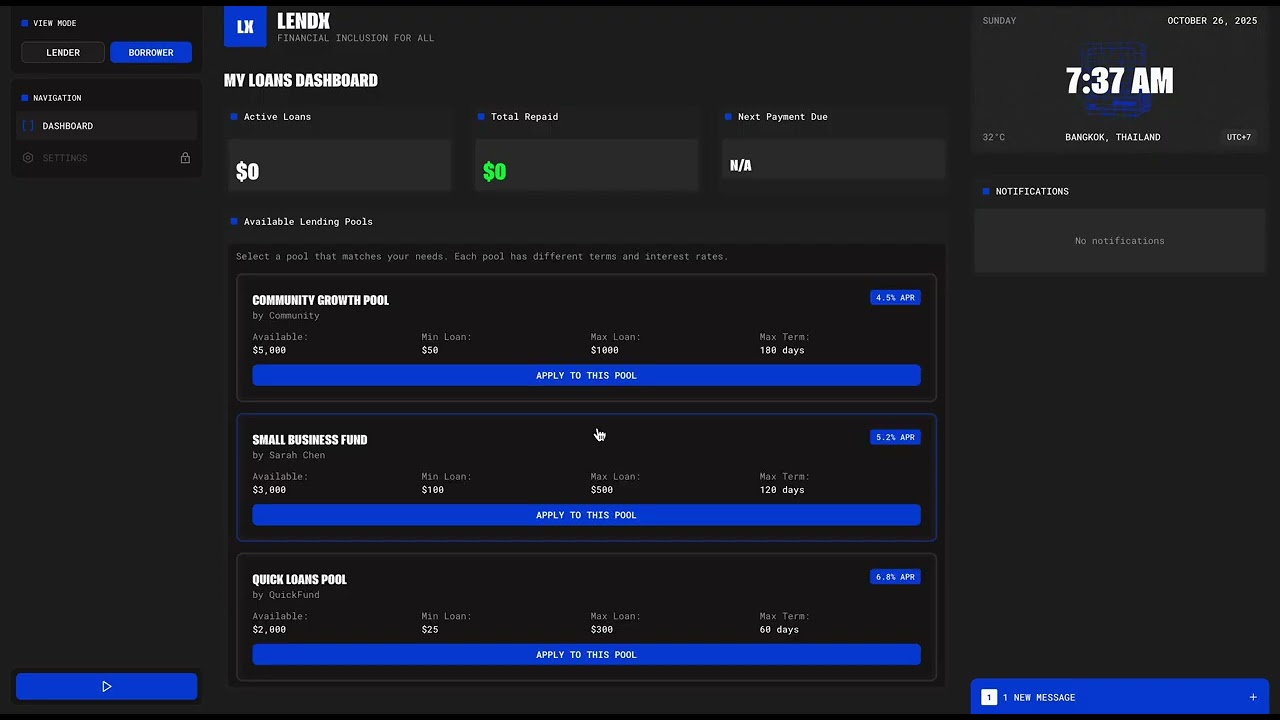

Borrower Dashboard:

- Browse available lending pools

- Apply for loans with purpose descriptions

- Track loan status and repayment schedules

- Make loan payments

from backend.xrpl_client import connect, submit_and_wait

from xrpl.wallet import Wallet

# Connect to XRPL network

client = connect('testnet') # or 'mainnet'

# Create a wallet

wallet = Wallet.create()

# Submit a payment transaction

tx = {

"TransactionType": "Payment",

"Account": wallet.address,

"Destination": "rDestinationAddress",

"Amount": "1000000" # 1 XRP in drops

}

result = submit_and_wait(client, tx, wallet)from backend.xrpl_client import create_issuance, mint_to_holder, get_mpt_balance

# Create MPT issuance for loan representation

issuance_id = create_issuance(client, issuer_wallet, "LOAN", "LendX Loan Token")

# Mint tokens to represent loan amount

tx_hash = mint_to_holder(client, issuer_wallet, borrower_address, 100.0, issuance_id)

# Check token balance

balance = get_mpt_balance(client, borrower_address, issuance_id)from backend.xrpl_client import create_deposit_escrow, finish_escrow

# Create escrow for loan collateral

sequence = create_deposit_escrow(client, borrower_wallet, 1000000, lender_address)

# Release escrow when loan is repaid

tx_hash = finish_escrow(client, lender_wallet, borrower_address, sequence)from backend.xrpl_client import setup_multisig_account, create_multisig_tx

# Setup multisig account for institutional lending

signers = ["rAddress1", "rAddress2", "rAddress3"]

tx_hash = setup_multisig_account(client, master_wallet, signers, threshold=2)

# Create multi-signed transaction

multisig_blob = create_multisig_tx(tx_json, [wallet1, wallet2])Create a .env.local file in the frontend directory:

# Auth0 Configuration

AUTH0_SECRET='use [openssl rand -hex 32] to generate a 32 bytes value'

AUTH0_BASE_URL='http://localhost:3000'

AUTH0_ISSUER_BASE_URL='https://your-tenant.auth0.com'

AUTH0_CLIENT_ID='your_auth0_client_id'

AUTH0_CLIENT_SECRET='your_auth0_client_secret'

# XRPL Configuration

NEXT_PUBLIC_XRPL_NETWORK=testnet # or mainnet

NEXT_PUBLIC_XRPL_WEBSOCKET=wss://s.altnet.rippletest.net:51233

# Optional: Xumm Wallet Integration (legacy)

NEXT_PUBLIC_XAMAN_API_KEY=your_xaman_key

NEXT_PUBLIC_XAMAN_API_SECRET=your_xaman_secret# Run Python backend tests

pytest

# Run frontend linting

cd frontend

npm run lint

# Build frontend for production

npm run build- Next.js 14: React framework with App Router

- TypeScript: Type-safe JavaScript development

- Tailwind CSS: Utility-first CSS framework

- Shadcn/ui: Component library built on Radix UI

- Auth0: Authentication with Google SSO

- Framer Motion: Animation library

- XRPL.js: Direct XRPL blockchain integration

- Zustand: State management

- Python 3.11+: Core backend language

- FastAPI: High-performance web framework

- xrpl-py: Official Python XRPL library

- Supabase: PostgreSQL database

- SQLAlchemy: ORM for database operations

- Pydantic: Data validation

- pytest: Testing framework

- XRP Ledger: Layer-1 blockchain with native DeFi features

- Multi-Purpose Tokens (MPT): Native token standard for loan representation

- Escrow: Built-in escrow functionality

- Multi-signature: Native multi-sig support

- Vercel: Frontend deployment platform

- GitHub Actions: CI/CD

- XRPL's low transaction fees (fractions of a cent) make microlending economically viable at scale

- Multi-Purpose Tokens (MPT) provide an efficient solution for representing complex financial instruments on-chain

- Native blockchain integration significantly improves user experience compared to external wallet dependencies

- Verifiable credentials (DIDs) combined with OAuth create a powerful identity verification system

- Real-time feedback is critical for financial applications

- Progressive disclosure improves user confidence in complex workflows

- Professional dark themes reduce eye strain during extended sessions

- Test-driven development catches edge cases early

- Clean architecture with distinct layers improves maintainability

- Type safety (TypeScript + Pydantic) eliminates entire classes of bugs

- Complete end-to-end lending flow working on XRPL testnet

- Production-grade UI/UX rivaling traditional fintech applications

- Native XRPL integration without external wallet dependencies

- Comprehensive Python XRPL library with MPT, escrow, and multi-sig support

- Real-time transaction monitoring with WebSocket updates

- PostgreSQL integration with SQLAlchemy ORM

- Addressing financial exclusion affecting 1.7 billion people globally

- Demonstrated economic viability of microlending with XRPL's low costs

- Multi-signature support suitable for institutional lenders

- Scalable architecture for individual and large-scale lending

- Mainnet deployment on XRPL production network

- Integrated fiat on/off ramps

- Security audits and smart contract verification

- Multi-currency support (USD, EUR, NGN, INR, BRL)

- On-chain credit scoring algorithm

- Machine learning models for default prediction

- Borrower reputation system with verifiable credentials

- Automated interest rate adjustment

- Insurance pools to protect lenders

- Parametric insurance using on-chain oracles

- Yield optimization for lenders

- Default recovery mechanisms

- Progressive Web App (PWA) for emerging markets

- SMS-based notifications

- Offline-first architecture for low-connectivity regions

- Native mobile apps for iOS and Android

- Self-sovereign identity integration

- Cross-chain lending support

- Institutional lending products

- Developer API and SDK

- Decentralized governance (DAO)

We welcome contributions from the community! Whether you're fixing bugs, adding features, or improving documentation, your help makes LendX better.

-

Fork the repository

git clone https://github.com/sureenheer/lendx.git cd lendx -

Create a feature branch

git checkout -b feature/amazing-feature

-

Make your changes and commit

git commit -m 'feat: add amazing feature' -

Push to your fork

git push origin feature/amazing-feature

-

Open a Pull Request

- Provide a clear description of the changes

- Reference any related issues

- Include screenshots for UI changes

- Follow existing code style and conventions

- Write tests for new features

- Update documentation for API changes

- Ensure all tests pass before submitting PR

For detailed guidelines, see CONTRIBUTING.md.

This project is licensed under the MIT License - see the LICENSE file for details.

- Cal Hacks 2025 - First Place Winner

- Ripple - Best Use of XRP Ledger Award

- XRPL Foundation - XRP Ledger documentation and developer resources

- Ripple - Enterprise blockchain solutions and XRPL ecosystem support

- Auth0 - Authentication and identity management

- Vercel - Frontend deployment and hosting

- Supabase - PostgreSQL database infrastructure

- Cal Hacks 2025 Organizers

- XRPL Developer Community

- All Cal Hacks 2025 Participants

Built at Cal Hacks 2025

Live Demo • Watch Demo Video • Report Bug • Request Feature

Made by the LendX Team | © 2025 | MIT License